If you’ve always enjoyed math and statistics, a career in chartered accounting may be the best fit for you. The journey to become a CA is tough that is the reason CA’s are widely recognised and respected. It shouldn’t be surprising that one of India’s most renowned designations is CA. Let’s now quickly discuss the CA course, which can be enrolled straight away after passing the 12th.

Financial analysis, auditing, taxes, and company accounting are all covered by CA, or chartered accounting. The ICAI (Institute of Chartered Accountants of India) controls the course’s administration. Candidates working in a firm’s tax and financial sector after becoming CA are designated as auditors, consultants, financial managers, and more.

If you’re considering pursuing Chartered Accountancy, this article will be beneficial. We’ll go over all the intricacies of how to become a CA after 12th and CA after graduation in this article which will help you to begin your CA career.

About Chartered Accountant and its role:

What is Chartered Accountancy?

Your understanding of the financial world will improve thanks to the Chartered Accountancy program which will enable you to manage a firm’s finances through accounting, auditing, budgeting and taxation modules. The Chartered Accountants Act, 1949 (Act No. XXXVIII of 1949) created the Institute of Chartered Accountants of India (ICAI), a statutory entity, to regulate chartered accounting practice in the nation. The Ministry of Corporate Affairs of the Government of India oversees the administrative operations of the Institute. Chartered Accountants are people who have qualified for all the required chartered accountancy exams.

Why Chartered Accountancy?

Chartered Accounting (CA) is one of the nation’s most challenging and sought-after professional degrees like CMA and CS. It also offers good income, making it the ideal career for many people. Here are five possible advantages of selecting a profession in accounting.

- A wide range of adaptability is offered by chartered accounting.

- The discipline of CA is reliable and safe.

- The compensation packages provided by CA are competitive.

- A chartered accounting degree can lead to a global career.

Responsibilities of a CA

When it comes to taking a CA course, the CA candidates get the requisite information and hands-on training throughout their Articleship, as well as all the pertinent abilities necessary on the part of a CA. After becoming CAs, the people are in charge of managing a variety of jobs and obligations. The following list includes several of the CA’s duties:

- Make and keep financial statements and budgets.

- Performing organization-wide financial audits

- Provide customers with advice on tax preparation, corporate acquisitions, and mergers, financial risks, etc.

- Give your clients involved in the economy the appropriate guidance and counselling.

- The provision of tax and auditing assistance

- Financial statement monitoring and evaluation

- Create for the business monthly financial reports.

- Address the company’s economic issues.

How to become a CA after 12th or after graduation in India?

Now you know the fundamentals of CA’s and your curiosity on how to become a CA must be piqued.

Students interested in CA certification can get in one of the two ways. A bachelor’s degree or after the completion of the 12th grade. The CPT (Common Proficiency Test) path or the CA Foundation, is for students who want to continue their CA studies after completing grade 12. In contrast, the direct admission program is for people who desire to become CAs after graduation, then the CA foundation is exempted for graduates. To become a CA in India, candidates must qualify for the criteria, pass the exams, and get the necessary training.

ICAI has offered two options for students to finish CA certification training.

- CA After Class 12 through CA Foundation (CPT Route)

- CA After Graduation through Direct Entry Scheme

CA after 12th through CA Foundation (CPT Route)

After completing their 12th grade, applicants who wish to enrol in the Chartered Accountancy program must first be eligible to take the CA Foundation examination. The candidates shall register on or before 4 months before the exam date held twice in May/November or June/December.

Steps on how to become CA after the 12th are listed below:

- A candidate must register and pay the CA foundation registration fees 4 months before the date of examination.

- The candidate must pass the foundation course of four papers.

- Those who have passed the CA Foundation test and their 12th-grade exams can register for the CA intermediate.

- Complete the 8-month training and pass the Group I and Group II exams.

- Complete the ICITSS and Advanced ICITSS training, self-paced online modules and practical training for 2 years before registering for the CA Final.

- Register for the CA final, qualify for both group exams and become a CA.

CA after graduation through the Direct Entry Scheme

Graduates wishing to become chartered accountants might choose the direct entrance route. Graduates can cut time and costs by avoiding the Foundation level. It is crucial to remember that only some are a good fit for the direct admission program. Graduates who feel they need more confidence in their accounting abilities shall start with the Foundation level.

The Direct entry scheme is for graduates and postgraduates who are all eligible to register directly for CA intermediate and can skip the CA foundation course. Direct entrance is also available to those who have passed the intermediate phase of the CS executive or CMA.

The steps for how to become a CA after graduation are listed below

- Candidates shall register for CA intermediate and pay the registration fees.

- Candidates should complete 8 months of intermediate training and pass group I and group II exams.

- Complete the ICITSS and Advanced ICITSS training, self-paced online modules and practical training for 2 years before registering for the CA Final.

- Register for the CA final, qualify for both group exams and become a CA.

We recommend you check the ICAI website where they share clear and substantial details about the CA course and many other important things that you must know.

Eligibility to become CA

The CA program has three levels of courses Foundation, Intermediate and Final. Therefore, we have CA eligibility after the 12th, eligibility after graduation and eligibility for the CA final.

CA Foundation Course eligibility

CA foundation course is route 1 and is to be followed by students who want to become CA after the 12th. Below are the required criteria to register for the CA Foundation course:

- Candidates must have passed 10+2 exams from an accredited board.

- Candidates awaiting their high school diploma results may apply provisionally for the program.

- Application for the CA Foundation course is open to students of all ages.

CA Intermediate Course eligibility

CA intermediate can be taken through both routes. Above, we have mentioned the CA foundation course eligibility after the 12th, and now we will see CA eligibility after graduation, which is a direct entry route.

The following criteria must be satisfied by students to register for the CA Intermediate:

- Candidates need to have passed the CA foundational test if coming through the Route 1 foundation course

- Commerce graduates/ postgraduates with a minimum of 55% marks or Other Graduates/ Postgraduates with a minimum of 60% marks can choose the direct entry route and register for CA Intermediate

CA Final eligibility criteria

Students for the CA final-level course must meet the following criteria

- Candidates must have passed the Group 1 and 2 Intermediate level CA exam.

CA course details

Different levels of CA course

What you saw above, the different levels of CA courses that are Foundation, Intermediate and Final, we will go into detail now.

Candidates pursuing this course have to take the CA examinations, which are offered at several levels during the course. The ICAI administers these tests in May/November or June/December.

1. CA Foundation

The ICAI’s entry-level CA course is the Foundation course. It was formerly known as the Common Proficiency Test and a well-known program within Chartered Accountancy. Students shall register before 4 months of the foundation exam. CA foundation course consist of 4 papers.

- Paper-1: Principles and Practice of Accounting

- Paper-2: Business Laws and Business Correspondence and Reporting

- Paper-3: Business Mathematics, Logical Reasoning and Statistics

- Paper-4: Business Economics and Business and Commercial Knowledge

The CA foundation test follows a precise grading formula.

CA Foundation exam Scheme:

| Particulars | Details |

| No. of Papers | 4 |

| Total Marks | 400 (100 each) |

| Time | 3 hours for paper 1&2 and 2 hours for paper 3 & 4 |

| Exam Pattern | Paper 1 & 2 subjectivePaper 3 & 4 objective |

| Pass Criteria | 3 hours for paper 1&2 and 2 hours for paper 3 & 4 |

2. CA Intermediate

The second-level course in chartered accounting is the CA Intermediate course or CA Inter. The course is divided into two groups, each with 3 subjects. To receive a CA intermediate credential candidates shall register and complete 8 months of theoretical education. Let’s see the syllabus and course’s grading policy below.

- GROUP I

- GROUP II

- Paper-4: Cost and Management Accounting

- Paper-5: Auditing and Ethics

- Paper-6: Financial Management and Strategic Management

CA Intermediate exam Scheme:

| Particulars | Details |

| No of Papers | 6 |

| Full Marks | 600 |

| Question Type | Objective and subjective |

| Languages | Hindi and English |

| Time for each paper | 3 Hours |

| Passing Criteria | minimum of 40% marks in each paper and a minimum of 50% marks in the aggregate of all the papers. |

3. CA Final

The program’s last level is the CA Final or Chartered Accountancy final course. Candidates must complete Groups I and II of the CA Intermediate course along with the Integrated Course on Information Technology and Soft Skills (ICITSS). Before registering for the CA final, you have to register for self-paced online modules that contain 4 papers of 100 marks each. A 2-year practical training program is mandatory and to be completed 6 months before the CA final exam. CA final is divided into two groups with 3 subjects each.

- GROUP I

- GROUP II

CA Final exam scheme

| Particulars | Details |

| No of Papers | 6 |

| Full Marks | 600 (100 each) |

| Question Type | Both objective and Subjective |

| Languages | Hindi and English |

| Time for each paper | 3 Hours |

| Passing Criteria | minimum of 40% marks in each paper and minimum of 50% marks in the aggregate of all the papers. |

Let’s see self-paced modules

- Paper 1: Corporate and Economic Laws

- Paper 2: Strategic Cost & Performance Management

- Paper 3: Elective

- Paper-1 : Risk Management

- Paper-2: Sustainable Development and Sustainability Reporting

- Paper-3 : Public Finance and Government Accounting

- Paper-4 : The Insolvency and Bankruptcy Code, 2016

- Paper-5: International Taxation

- Paper-6 : The Arbitration and Conciliation Act, 1996

- Paper-7 : Forensic Accounting

- Paper-8 : Valuation

- Paper-9 : Financial Services and Capital Markets

- Paper-10 : Forex and Treasury Management

- Paper 4: Elective

Self Paced Module

| Particulars | Details |

| No of Papers | 4 |

| Full Marks | 400 (100 each) |

| Question Type | Objective |

| Passing marks | minimum of 50% marks in each paper |

4. Business Accounting Associate

Business Accounting Associate(BAA) is for students who could not complete the CA Final. If a candidate has completed both groups of CA Intermediate, ICITSS and Advanced ICITSS training, self-paced online modules and practical training for 2 years can apply for BAA. After getting a BAA, you can still apply for the CA Final exam.

CA Course Registration Fees

The Chartered Accountants Institute of India (ICAI) determines the registration costs. Below are the registration fees listed that a candidate will spend to become the CA in India:

| S.No | CA Level | CA Registration Fees |

| 1 | Foundation Level | INR 9,000 |

| 2 | Intermediate Level | INR 18,000 |

| 3 | Articleship Fees | INR 2,000 |

| 4 | Integrated Course on Information Technology and Soft Skills (ICITSS) | INR 7,000 |

| 5 | Direct Entry | INR 34,000 |

| 6 | Final Level | INR 22,000 |

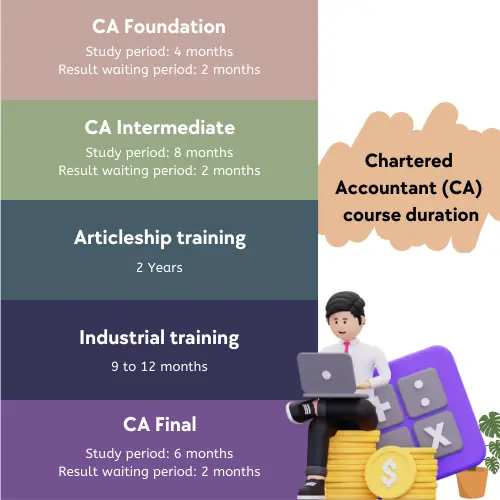

CA Course Duration for Foundation, Inter and Final

The CA Course lasts 4.5 – 5 years following the 12th grade, whereas after graduation/postgraduation, the CA course lasts for 4 – 4.5 years. We have listed below the CA course duration at each level:

- CA Foundation: The CA Foundation Course lasts six months, including a two-month waiting time and a four-month study term.

- CA Intermediate: Candidates must wait two months for the CA Inter outcomes after completing an 8-month study time for the course. As a result, the Intermediate will last for a total of 10 months.

- Training for an articleship in accounting lasts a total of two years.

- CA Final: The CA Final Course requires six months of preparation. Additionally, it will take two months to release the CA Final results, totalling eight months. Students may, however, also prepare for their CA Final examinations while completing the articleship and take the tests sooner.

- Further 1 Year certificate of practice(COP) to work in industry.

The length of the CA course, however, is determined by the entry method you chose and the number of times you’ve attempted to pass each level.

Top CA Institutes in India

The top five CA institutes that guide applicants in getting ready for the CA Exam are:

| S.No. | Name of the Institute | Average Fees |

| 1 | Aldine CA | INR 19,000 PA |

| 2 | Resonance | INR 20,000 PA |

| 3 | Vidya Sagar Career Institute Ltd | INR 45,000 PA |

| 4 | Northern India Regional Council of ICA | INR 11,000 PA |

| 5 | Nahata Professional Academy | INR 43.000 PA |

Jobs, Salaries, scopes

CA Expected Salary

The CA salary in India ranges from INR 5 LPA to INR 8 LPA. However, after getting more knowledge and expertise, it may increase to INR 40-60 LPA.

However, given that CA has broad profiles, let’s take a glimpse at some of the well-known portfolios and their typical initial yearly packages.

| POSITIONS OF RESPONSIBILITIES | AVERAGE ANNUAL SALARY (INR) |

| Chartered Accountant | 7 LPA |

| Finance Manager | 12 LPA |

| Financial Advisor | 4 LPA |

| Financial Analyst | 4 LPA |

| Auditor | 5.5 LPA |

| Internal Auditor | 6.3 LPA |

| Public Accountant | 9.5 LPA |

| Cost Accountant | 5.0 LPA |

| Government Accountant | 4.2 LPA |

| Taxation Expert | 6.9 LPA |

| Accounting Firm Manager | 7.3 LPA |

Career Scope & Opportunities for Chartered Accountants

In India, chartered accounting is one of the top occupations. CAs have several work options in both the public and private sectors. Working in major corporate and public organizations and opening your own company as an entrepreneur are all possible career paths in the CA profession. Additionally, chartered accountants in India enjoy a feeling of career stability and a variety of exciting options.

One can gain in-depth expertise in a specific finance-related subject after becoming a CA and obtaining employment. Several of the regions are:

- Internal Audit

- Taxation

- Statutory Audit

- Wealth Management

- Start their firm

- Goods & Service Tax

- Mergers and Acquisitions

There is a substantial need for Indian CAs all across the world. Indian chartered accountants are in high demand in West Asian nations, Singapore, and Australia. Each year, a large number of Indian CAs travel to these nations. Memorandums of Understanding (MOU) forged between the ICAI and different nations, including Canada, Australia, the United Arab Emirates, the United Kingdom, and others, led CAs to qualify for a few exams and practice in a particular country.

Conclusion

You may be aware now of how to become a CA after 12th and graduation. Well, CA is a profession that is lucrative and challenging. Although many students fail because of the low pass rate, it is manageable if you make things challenging for yourself. CA profession is for students who have an interest in finance and Commerce. Other courses in finance and commerce are rising with their opportunities such as ACCA, CFA and CMA.

If you are from a commerce background and want to explore different career options after 12th Commerce, then do check our best article below. We have curated a very brilliant comparison between finance courses that will help you in deciding your career.